In times of uncertainty, knowledge may mean the difference between confidence and chaos. Backed by 100 years of investment experience, MFS experts arm you with the insights, learnings and client educational resources to turn challenges into investment opportunities.

-

Timely Insights

Timely Insights to Navigate Market Dynamics

Equity Insight | ReadPBOC Provides a Positive Surprise

Discusses the surprise announcement by the People's Bank of China (PBOC) to inject liquidity into capital markets in a set of easing measures designed to support the housing and stock markets.

Strategist's Corner | READTo Find the Bust, You Need to Find the Boom

Capital cycles are imperfect, showing a tendency for booms and busts. Over the past year, investors have focused on the economy and interest rates when assessing risk. That emphasis may be misplaced because that wasn’t where the boom was.

LTCME | READMFS Long-Term Market Expectations Webcast Q&A Summary

Summary of the questions and answers from the Mid-Year Long-Term Capital Market Expectations webcast.

-

Learnings

Learnings to Put Market Events Into Perspective

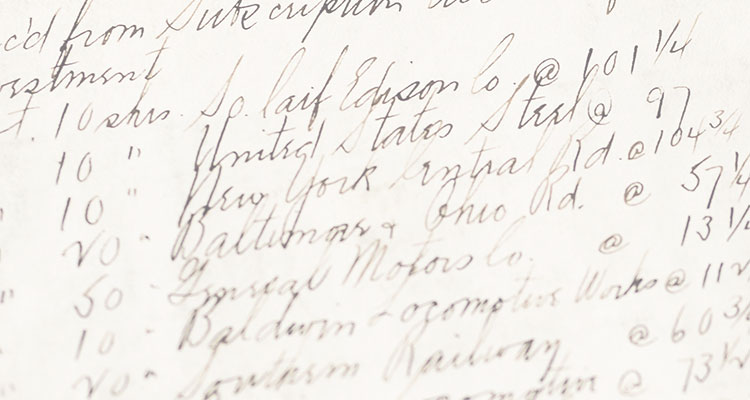

Market InsightLessons Learned from 100 Years of Investing

With 100 years of investing experience, MFS has the unique ability to provide insight into the lessons we have learned that can help our clients work toward meeting their investment objectives.

Multi-Asset InsightThe Other Side of Market Concentration Peaks

This paper covers the growing interest surrounding global pockets of market concentration. It examines the extreme concentration in the market and explores topics such as the historical view of market concentration and what follows periods of extreme concentration.

The Big MacThe Big Mac on Fixed Income Allocation

In this edition of The Big Mac, we discuss the role of fixed income in a positively correlated world.

-

Opportunities

Turning Dislocations into Opportunities

Fixed Income Insight | ReadThe Stars May Be Aligning for EUR Credit

With yields having corrected much higher over the past couple of years, global fixed income is once again a relevant asset class. In this paper we highlight the attractiveness of European IG Credit.

Equity InsightOpportunities in Global Growth

This paper discusses our global approach to stock picking within a Growth equity framework, new opportunities and trends in the investment landscape, and the importance of investing through the cycle in companies with durable earnings.

Equity Insight | ReadExploring Opportunities for Global Small- and Mid-Cap Stocks in the Next Cycle

We believe global small- and mid-cap asset classes remain a compelling area for asset allocators as the markets enter the next phase of the cycle.

Timely Insights to Navigate Market Dynamics

PBOC Provides a Positive Surprise

Discusses the surprise announcement by the People's Bank of China (PBOC) to inject liquidity into capital markets in a set of easing measures designed to support the housing and stock markets.

To Find the Bust, You Need to Find the Boom

Capital cycles are imperfect, showing a tendency for booms and busts. Over the past year, investors have focused on the economy and interest rates when assessing risk. That emphasis may be misplaced because that wasn’t where the boom was.

MFS Long-Term Market Expectations Webcast Q&A Summary

Summary of the questions and answers from the Mid-Year Long-Term Capital Market Expectations webcast.

Learnings to Put Market Events Into Perspective

Lessons Learned from 100 Years of Investing

With 100 years of investing experience, MFS has the unique ability to provide insight into the lessons we have learned that can help our clients work toward meeting their investment objectives.

The Other Side of Market Concentration Peaks

This paper covers the growing interest surrounding global pockets of market concentration. It examines the extreme concentration in the market and explores topics such as the historical view of market concentration and what follows periods of extreme concentration.

The Big Mac on Fixed Income Allocation

In this edition of The Big Mac, we discuss the role of fixed income in a positively correlated world.

Turning Dislocations into Opportunities

The Stars May Be Aligning for EUR Credit

With yields having corrected much higher over the past couple of years, global fixed income is once again a relevant asset class. In this paper we highlight the attractiveness of European IG Credit.

Opportunities in Global Growth

This paper discusses our global approach to stock picking within a Growth equity framework, new opportunities and trends in the investment landscape, and the importance of investing through the cycle in companies with durable earnings.

Exploring Opportunities for Global Small- and Mid-Cap Stocks in the Next Cycle

We believe global small- and mid-cap asset classes remain a compelling area for asset allocators as the markets enter the next phase of the cycle.